From equipment failures and regulatory hurdles to property damage and supply chain interruptions manufacturing businesses face unique risks every day. Our tailored manufacturing insurance solutions help reduce disruptions, protect your assets, and keep your operations moving forward with confidence and control.

401-500-5026

danielle@insurance-legacy.com

Running a manufacturing business means meeting the expectations of suppliers, partners, customers, and end users all at once. While producing goods for the masses is fulfilling, it also comes with its own set of risks and responsibilities.

That’s why having the right insurance isn’t just an added expense it’s a smart investment. Tailored small business insurance can help protect your operations today and grow alongside your company in the future, shielding you from unexpected financial challenges.

Any business involved in producing or assembling products should carry manufacturer insurance to safeguard against potential risks. This includes, but isn’t limited to:

Bottling & Canning Plants

Apparel & Textile Manufacturers

Electronics & Computer Equipment Producers

Food Mills, Refineries & Meat Packing Facilities

Furniture & Plastic Goods Manufacturers

Mobile Home Builders

Printers, Publishers & Fabricators

Tool & Die Shops

Tobacco Processing Plants

And many more…

Essential Insurance Coverage for Manufacturers

Most fabrication and manufacturing businesses benefit from a Business Owner’s Policy (BOP) a bundled insurance plan designed to offer broad protection much like homeowners insurance does for your residence. A BOP typically includes:

General Liability Insurance – Helps cover legal costs from injuries or property damage caused by your business. This includes incidents like a customer injury on your shop floor or claims of slander or libel.

Commercial Property Insurance – Protects your business location, machinery, and tools (like injectors, molds, and plastics), whether owned or leased.

Business Income Insurance – Replaces lost income if you’re unable to operate due to a covered event such as a fire or natural disaster.

Workers’ Compensation Insurance

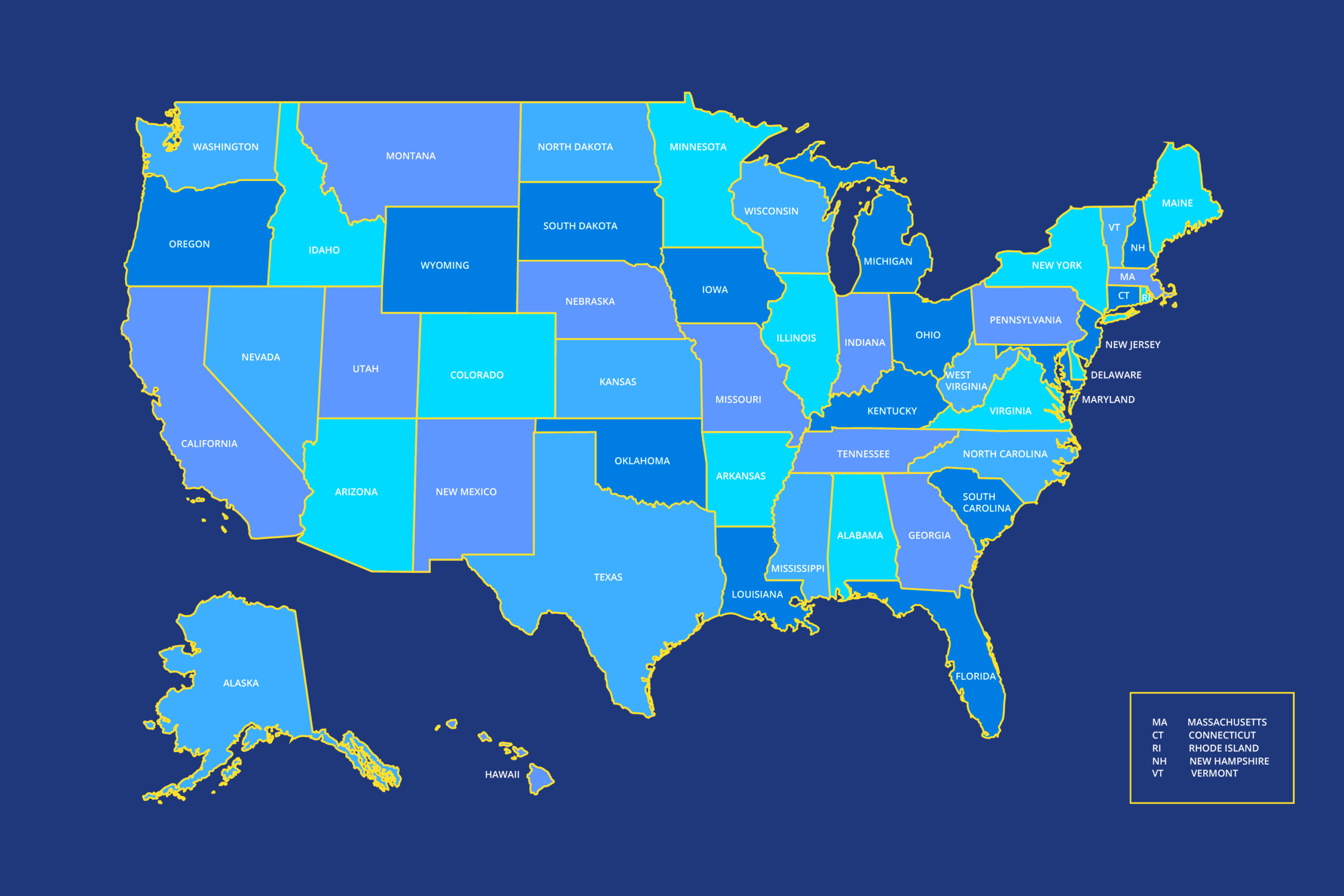

In most states, workers’ comp is legally required. It provides coverage for employees suffering from work-related injuries or illnesses, including medical expenses, lost wages, and legal fees if your business is sued by the injured worker’s family.

Commercial Auto Insurance

If you or your team use personal or company vehicles for business tasks like attending meetings or picking up supplies commercial auto insurance can fill the gaps left by personal auto policies and offer vital protection.

Let our experts help you find the right combination of coverage, customized for your manufacturing operation efficiently and affordably.

Subscribe our newsletter to get our latest update & news.

Copyright © 2024 Rometheme. All Rights Reserved.