Nearly all drivers in the United States are legally required to have auto insurance. In the event of an accident, auto insurance helps protect you from significant financial loss by covering vehicle repairs and medical costs.

401-500-5026

danielle@insurance-legacy.com

Auto insurance is a contract that helps cover the costs of accidents, theft, or damage to your vehicle. It’s essential for protecting you financially from vehicle repairs, medical bills, and liabilities to others involved in an accident.

Here are the key types of auto insurance coverage you should know about:

Liability: Covers damages and injuries you cause to others, including bodily injury and property damage.

Collision: Pays to repair or replace your vehicle after an accident.

Comprehensive: Usually optional, this covers damage from non-collision events like fire, theft, windshield cracks, or animal collisions.

Uninsured Motorist: Protects you if the at-fault driver lacks insurance.

Underinsured Motorist: Covers costs when the at-fault driver’s insurance isn’t enough to cover damages or medical bills.

Personal Injury Protection: Pays your medical expenses after an accident, regardless of fault.

Additional optional coverages include GAP insurance, Roadside Assistance, Glass Coverage, Mechanical Breakdown, Rental Reimbursement, and more.

Auto insurance is essential because it provides financial protection if you cause damage to someone else’s vehicle or injure them in an accident. It also safeguards your own vehicle against damage from accidents or other covered events like fire, theft, or falling objects.

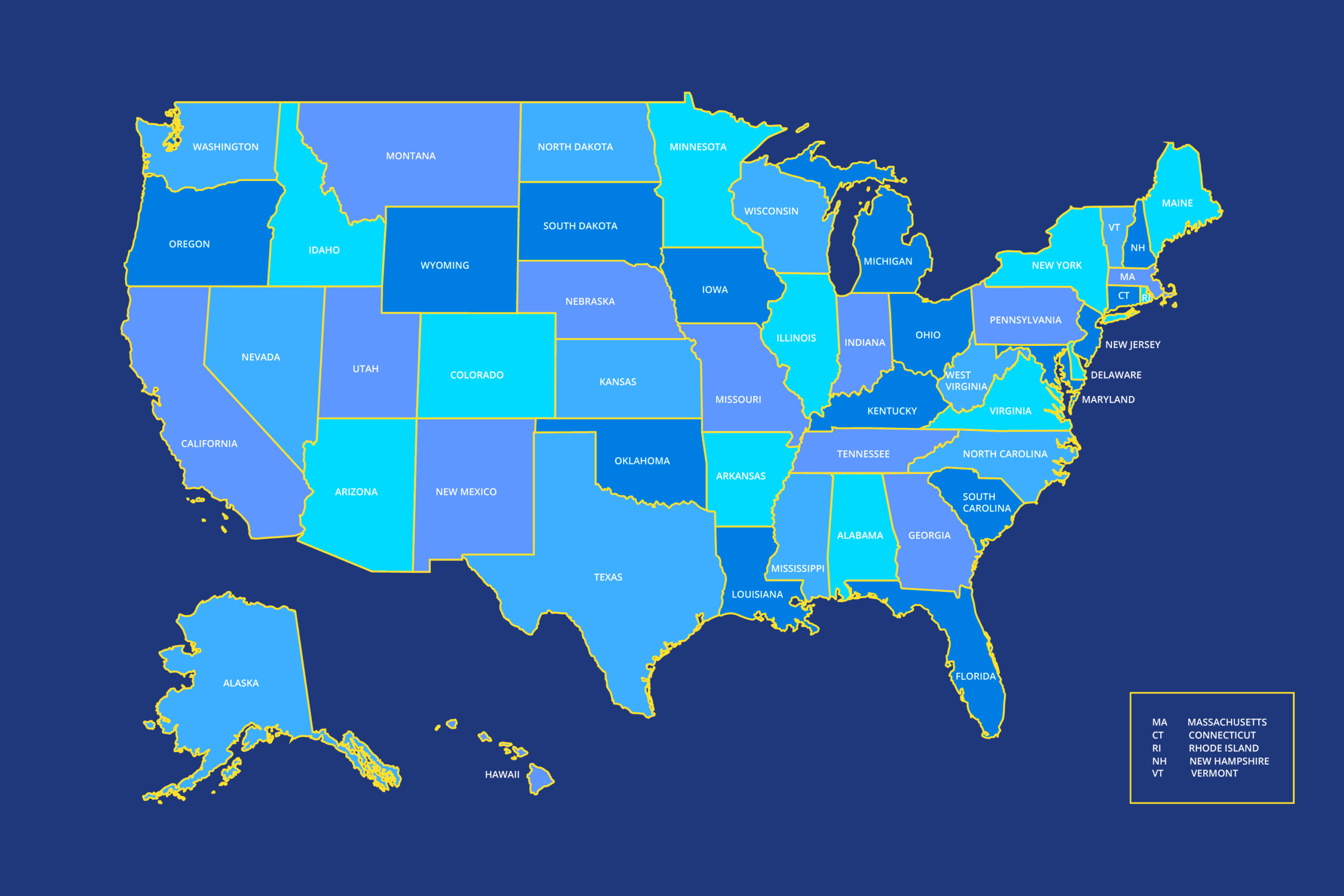

In many states, driving without insurance is illegal and can lead to fines or license suspension.

A typical auto insurance policy includes several types of coverage, each offering important protection. While not all coverages are legally required, state laws vary on minimum requirements. You can choose the best coverage with guidance from us.

Subscribe our newsletter to get our latest update & news.

Copyright © 2024 Rometheme. All Rights Reserved.