A Business Owner’s Policy (BOP) is essential for most businesses. It bundles property, liability, and income coverage into a single, convenient policy..

401-500-5026

danielle@insurance-legacy.com

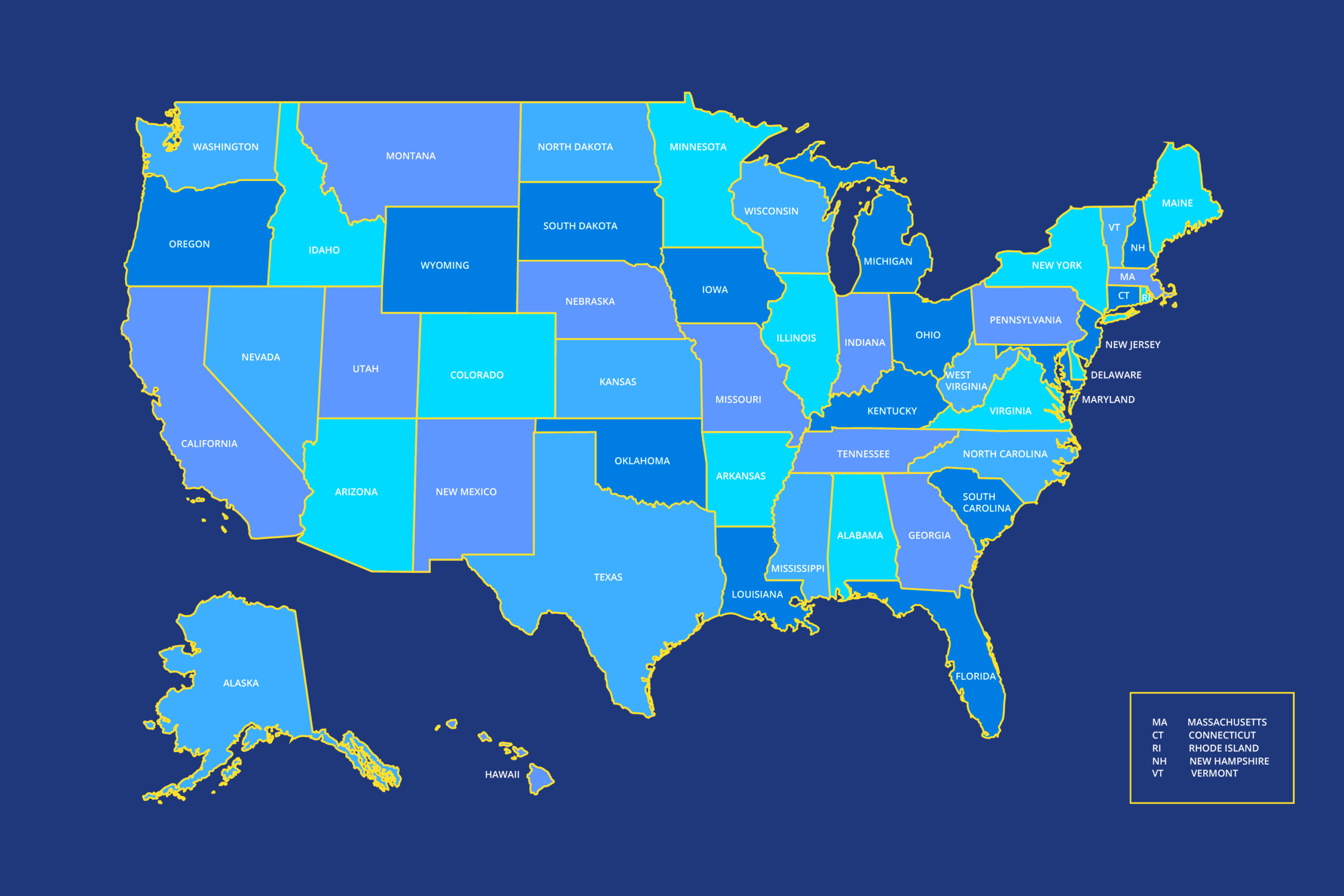

Business insurance is essential because it helps protect against unexpected costs from property damage or liability claims. Without it, business owners could face huge out-of-pocket expenses that may seriously impact their operations. In some states, certain types of business insurance are even legally required, making it a critical part of running a secure and compliant business.

Team & Staff

Accidents happen if an employee accidentally harms a customer or damages property, your policy has you covered.

Legal Risks

If someone is injured on your premises, your insurance can help cover medical bills and legal defense costs.

Business Location

Whether you operate from home, a leased office, or your own space, your BOP can help protect it.

Valuable Assets

From equipment and inventory to digital data and furniture, your coverage helps repair or replace stolen or damaged property.

Customer Information

In the event of a data breach, your policy can assist with notification costs, reputation management, and more.

Subscribe our newsletter to get our latest update & news.

Copyright © 2024 Rometheme. All Rights Reserved.