As a business owner, it’s essential to insure the vehicles you use for work whether they’re cars, trucks, or vans just like you would your personal ones. Since a Businessowners Policy (BOP) doesn’t cover vehicles, you’ll need a separate commercial auto or fleet insurance policy to stay protected.

401-500-5026

danielle@insurance-legacy.com

Essential fleet insurance coverages include:

Liability Insurance (bodily injury, property damage)

Medical Payments

Physical Damage (comprehensive, collision, specified perils)

Uninsured/Underinsured Motorist Coverage

Collision Deductible Waiver (CDW)

Additional coverages may include:

Rental and towing services

Coverage for vehicle accessories (like GPS units, radios, mileage meters)

Let us help tailor a fleet policy that fits your business perfectly.

The cost of a fleet insurance policy depends on several key factors, including:

Number of Vehicles: More vehicles generally increase the premium.

Vehicle Types: The make, model, and purpose (e.g., delivery vans vs. company cars) impact pricing.

Driver Histories: Clean driving records can reduce costs, while past violations can raise them.

Business Type: The industry you operate in and how vehicles are used influence the risk level.

Coverage Limits & Deductibles: Higher coverage limits or lower deductibles typically mean higher premiums.

Claims History: A strong history with few or no claims may lower your insurance rates.

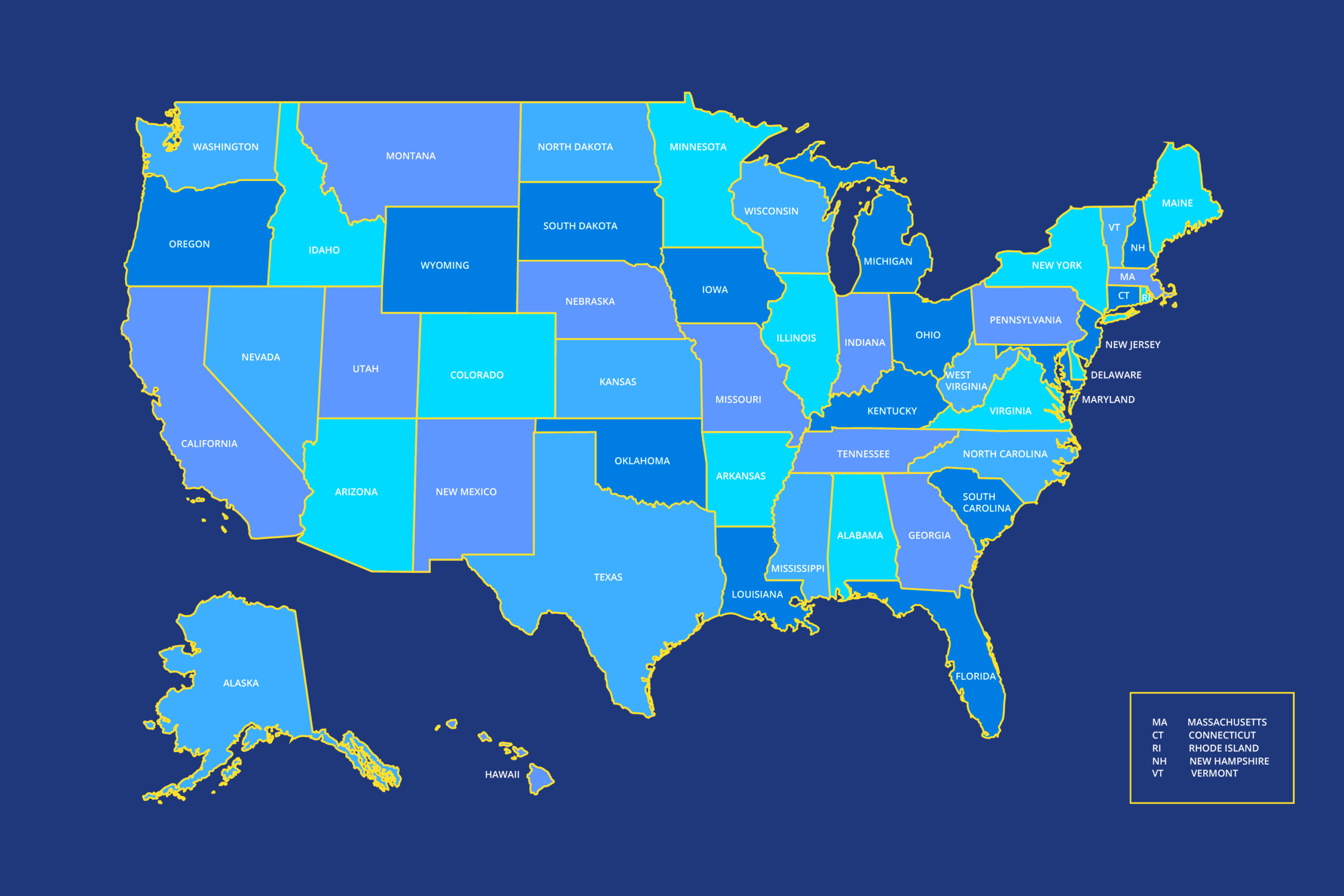

Location: Areas with high traffic or accident rates can increase costs.

Our team can help you assess these factors and find the best value fleet insurance that suits your business.

Commercial umbrella insurance offers extended protection by stepping in when your primary liability policies reach their limit. It’s designed to help cover costly claims that could otherwise impact your business’s financial stability. From large lawsuits to unexpected accidents, this added coverage helps ensure you’re not left paying out-of-pocket for excess expenses.

Let us help you explore the best commercial umbrella policy tailored to your business needs.

Subscribe our newsletter to get our latest update & news.

Copyright © 2024 Rometheme. All Rights Reserved.